May 1, 2022, Carlos Augusto Tortoro Jr., partner at Tortoro, Madureira & Ragazzi Advogados and responsible for the electric energy and strategic litigation area

INTRODUCTION

With the implementation of the hourly PLD in January 2021, previously ANEEL determined the creation and established a study group for the development and adequacy of mathematical models for the planning and dispatch of short-term hydrothermal power and the establishment of the marginal cost of operation, which ultimately culminates in the definition of the PLD.

Thus, the National Agency of Electric Energy – ANEEL, in January 2020, determined the opening of Administrative Proceeding No. 48500.000101/2020-28, within the scope of the Superintendency of Regulation of Generation Services – SRG, to approve and authorize the use of the DESSEM computer program, developed by the Electric Energy Research Center – CEPEL.

DESSEM is a mathematical model for short-term hydrothermal dispatch and is used by the National System Operator – ONS, for the daily operation of generation, and by the Electric Energy Trading Chamber – CCEE, for establishing the hourly PLD.

Obviously, the data for the operation of the system and the marginal cost of operation, which directly influences the settlement price for differences, count on other mathematical models, such as NEWAVE, for long and medium term planning, and DECOMP, also used in short term planning, with a weekly horizon.

Throughout 2020 several updates and corrections to the DESSEM mathematical model were made by the working group formed by ONS, CCEE and EPE, so that as of 2021 all planning and daily operation of the SIN, as well as the definition of the hourly PLD, would be carried out by the new software.

Although the Administrative Process in question deals with the approval of the mathematical model for short-term hydrothermal operation and dispatch, several issues involving the alteration of the annual energy operation planning for the 2020/2024 period arose and were analyzed by the regulator to the extent that it correlated, even indirectly, with the short-term operation planning.

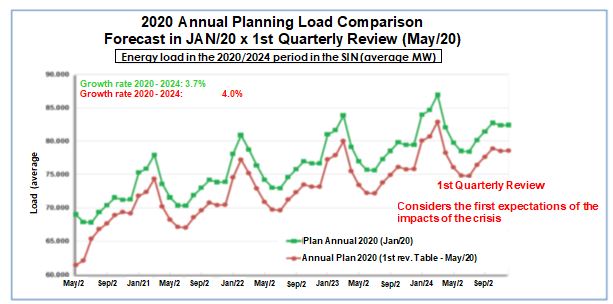

The first issue was the four-monthly review of the PEN 2020/2024, insofar as ONS verified a drastic decrease in the load due to the COVID-19 pandemic and that reflected in the planning, with consequences, including in the monthly operation planning, as can be seen in the chart attached to Letter NOS 0119/DGL/2020 (CT CCEE 0006/2020 and Letter no 0278/2020/PR/EPE):

Source: ANEEL

This situation led ONS to question the regulator agency about the safeguard of market predictability of any change in the PEN 2020/2024 data, with consequent change in the PMO, respecting the anteriority rule, as provided in Normative Resolution no. 843/20193 of ANEEL, according to which updates of information outside the pre-established schedules should be made one month in advance, except in the case of error correction, in accordance with § 1 of article 5:

Art. 5 The systematics, deadlines, responsibilities and products for the preparation of the PMO must be included in the ONS Network Procedures and must contain, at least: (…) § 1 If there is a need to update information for the PMO whose deadline is in disagreement with the schedules referred to in item IV, publicity must be given to the agents no less than one month in advance of the PMO.

In response to the consultation, ANEEL, through its Generation Services Regulation Superintendency, stated that there is a forecast for the extraordinary revision of the Energy Operation Annual Planning, as verified in a sub-module of the ONSs Network Procedures, for which reason there would be no mitigation of market predictability or any violation of the anteriority rule.

During the course of the process, another question that arose was the alteration of the operational policy for hydroelectric generation in the hydrographic basins, due to adverse and restrictive precipitation phenomena that put the electric supply at risk, which directly affected the planning of the daily operation of the SIN.

In this context, ONS dealt directly with the Ministry of Mines and Energy, ANEEL and the Waters and Sanitation National Agency – ANA about the outflow of some hydroelectric reservoirs, even if they were below their safety quotas. This was done in order to maintain the supply of electricity at safe levels and at the lowest possible global cost, especially in view of the preparation of the PMO for December 2020.

The fact is that the insertion of new data in the energy operation planning, as a result of hydraulic restrictions, caused as a logical consequence an alteration in the marginal cost of the operation besides reflecting in the settlement of differences price. With this, issues of predictability and anteriority have emerged in administrative debates, as will be explained further on.

It is important to emphasize that Order No. 3622/2020 refers only to the analysis and granting of a suspensive effect requested in an incidental administrative appeal and that in no way relates to the main object of Administrative Proceeding No. 48500.000101/2020-28, which deals with the approval of the mathematical model DESSEM, as already mentioned.

In fact, up to the time of writing of this investigation, this administrative appeal had not been definitively judged on its merits. However, this fact does not diminish the importance of the subject that is being analyzed here, which is the rule of anteriority in the formation of the price for the settlement of differences, especially due to the industry’s interest in seeking an effective price signal in the electric energy market, which justifies the current use of the hourly PLD.

The rule of anteriority is inserted here in the discussion as a way to mitigate the asymmetry of reverse information, i.e., as the price formation derives from the marginal cost of the operation and this value is obtained through the centralized operation of the national interconnected system by ONS, data changes in the mathematical models that affect the PLD need to be known by the market, so that there are no surprises and no breach of the objective basis of the legal business that surrounds the Brazilian electricity market.

Due to the unique characteristics of the Brazilian electricity system, which relies on centralized hydrothermal dispatch given by mathematical models and price formation for a wholesale free market, the relevance of the topic is evident in the observance of the anteriority rule for the formation of the PLD, which brings concern in obtaining price signals to the market that can at least mitigate the asymmetry of information between centralized dispatch and free market prices.

THE OPERATION OF THE NATIONAL INTERCONNECTED SYSTEM

As provided in art. 13 of Law No. 9.648/1998, the ONS is responsible for operating the generation and transmission of electricity in the National Interconnected System – SIN, in a centralized manner, under the regulation and supervision of ANEEL:

Art. 13. The activities of coordination and control of the operation of electricity generation and transmission that are part of the National Interconnected System (SIN) and the activities of load forecasting and operation planning of the Isolated System (Sisol) will be executed, by means of authorization from the granting authority, by the National Electric System Operator (ONS), a non-profit private legal entity, supervised and regulated by Aneel and integrated by holders of concession, permission or authorization and consumers who have exercised the option provided in arts. 15 and 16 of Law No. 9.074, of July 7, 1995, and that are connected to the basic grid.

It is also responsible for planning and programming the operation and centralized dispatching of generation, in order to optimize the interconnected electro-energetic systems, in the terms of item “a” of the sole paragraph of art. 13 of the aforementioned law.

The Brazilian National Interconnected System is characterized by the connection through transmission lines of electricity generation units and the load or consumption centers, making possible the transfer of electric power between different regions of the country, by means of centralized coordination, which allows the use of hydrographic potentials. However, the use of such hydrographic potentials imposes an additional difficulty, since it is a tropical country of continental latitudinal dimensions with great variations in rainfall and affluence between the exploited hydrographic basins.

Given this natural characteristic, the best use of the generation potential occurs with the interconnection of the country’s regions so that the great variations in affluence are duly used to generate electricity and contribute to the security of supply of the load centers, imposing an economic rationality in the interconnection between the geography of energy supply and the geography of load.

Nowadays, with the increase in intermittent/variable renewable energy sources, this economic rationale remains current, insofar as the strength of the winds or the intensity of the sun can also vary according to the latitudinal characteristics of the country.

The infrastructure created and which enables large transfers of electricity between the sub-regions of the country ends up having a great influence on the marginal cost of operation – CMO, as it allows the central operator to plan the operation at the lowest possible global cost by allowing the valuation of the price of water in the future according to the inflows from different hydrographic basins in different regions of the country. Thus, ONS can operate the system according to the optimal order given by the mathematical models and the future cost function.

It is important that the system operation occurs through mathematical models that use historical series of affluence in such a way that the product is a function of the

future cost of water, which allows the system to operate at the lowest global cost possible today and to define the marginal cost of operation, which is characterized by the cost of meeting an increase in load, that is, the cost of producing the next MWh that the system needs.

In the current configuration of the Brazilian electricity sector, which adopts a mercantile system, the CMO has another relevance, besides parameterizing the marginal cost of expansion, which is to establish the settlement price for differences in the short-term market.

This calculation of differences that occurs in the scope of the CCEE comes from one of the pillars of support of the mercantile model, which is the ballast for all the commercialization of electricity through bilateral contracts. The differences between the energy traded/consumed and the energy effectively contracted are settled by the PLD – Difference Settlement Price. One can see, then, a total connection between the operation of an interconnected hydrothermal system, with the calculation of the marginal cost of operation and the price formation in the free market for electricity, and it should be noted that the PLD has a minimum and maximum limitation established by ANEEL.

Finally, it is not too much to say that the possibility of exchanging electricity among the sub-regions of the country has a direct impact on the calculation of CMO, mainly due to the large differences of affluence among hydrographic basins with hydraulic uses in different regions of the country, which in turn impacts the formation of the short-term price on account of the PLD, mirroring the CMO. Furthermore, it is known that the use of reservoirs and the policy on hydrography are shared and any and all operational and hydrological constraints have an impact on the operation and definition of the CMO.

However, this impact, when it refers to the PLD, should respect the anteriority rule, that is, it will take effect in the short term price only 30 days later so that the market agents are aware of it and are not surprised, according to the policy established in the CMSE and ANEEL regulations.

In view of its legal attributions as the centralized operator of the Brazilian electric system and because of the preparation of the PMO for December 2020, the ONS sent LETTER ONS – 0315/DGL/2020 to Waters and Basic Sanitation National Agency – ANA requesting the relaxation of hydraulic restrictions of the reservoirs of the São Francisco River, on November 30, 2020. In the correspondence, the Operator signaled that:

“1. As ONS has presented in the Crisis and Monitoring Rooms coordinated by this Agency and in technical monitoring meetings of the Electric Sector Monitoring Committee (CMSE), during the last two months, we have been experiencing a transition between the dry and wet periods in the operation of the National Interconnected System (SIN) under adverse hydro-energetic conditions, with the observation of critical inflows in the basins integrating the Southeast/Central-West and South subsystems, as well as in the SIN as a whole”.

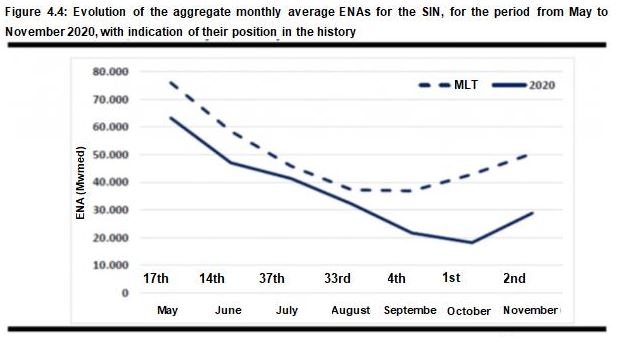

According to the Technical Note that supported the Correspondence sent to ANA, the system operator indicated a critical hydrological situation in all regions of the country, putting at risk the security of electricity supply, which, according to technical data, allowed for the flexibility of reservoir restriction in the São Francisco river basin, even though they were also in an adverse hydrological situation, as shown in the chart:

It is important to note that the ANA has the legal authority to define reservoir operating conditions, to guarantee the multiple use of water resources in the country, according to Law 9.984/2000:

Art. 4. The actions of ANA shall obey the foundations, objectives, guidelines and instruments of the National Water Resources Policy and shall be developed in articulation with public and private agencies and entities that are members of the National Water Resources Management System, and it shall be responsible for: (…) XII – defining and inspecting the conditions for reservoir operation by public and private agents, with a view to guaranteeing the multiple use of water resources, as established in the water resources plans of the respective hydrographic basins; (…) § 3 For the purposes of item XII of this article, the definition of the reservoir operating conditions of hydroelectric plants will be carried out in coordination with the National Electric System Operator – ONS.

And, through Normative Resolution no. 2.081/2017, “provides on the conditions for the operation of the São Francisco River Hydric System, which comprises the reservoirs of Três Marias, Sobradinho, Itaparica (Luiz Gonzaga), Moxotó, Paulo Afonso I, II, III, IV and Xingó.”

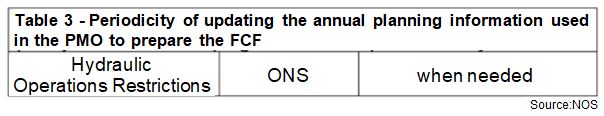

In considering the arguments presented by ONS, ANA, through Normative Resolution No. 51, dated December 3, 2020, authorized “exceptional operation of the São Francisco River Hydric System in December 2020.” With the alteration of the flows authorized by ANA, ONS updated the annual planning data, according to Submodule 7.2, table 3, of the Network Procedures (which in the current one does not have the exact correspondence), which indicates the possibility of updates by hydraulic operational restriction at any time.

As a logical consequence, the changes were replicated in the December 2020 PMO weekly review, already applicable for the second operating week of the month. That is, on December 5, 2020, the mathematical models NEWAVE, DECOMP and DESSEM would start running with the new updates.

It can be seen that the operation planning considers several variables that influence the results of the management software of the national interconnected system. Even though the system’s operating strategy derives from a robust study, “the planning of the operation of a hydrothermal system has to take into account a broad spectrum of activities, ranging from the multi-year optimization of the reservoirs to the order of the plants, taking into account the operating constraints.”

It is important to note that, by inserting the water restriction data, the values for the CMO and, in sequence, for the PLD would be altered, due to the modification of the scenarios provided by the mathematical models.

THE FORMATION OF THE DIFFERENCES SETTLEMENT PRICE – PLD

As stated above, the product of the PMO is the operation of the system at the lowest possible global cost, which means to say the CMO, according to the provisions of art. 17 of ANEEL Normative Resolution No. 843/2019.

Once the value of the marginal cost of operating the Brazilian interconnected system is established, the data is passed on by ONS to CCEE, under an operating agreement between the institutional agents, so that it is possible to establish a price for the amounts of electricity settled in what is called the short term market.

In fact, it is important to note what is established in art. 20, § 1, of ANEEL Normative Resolution 843/2019:

Art. 20. The PLD calculation process will be prepared and coordinated by the CCEE, with ONS support. § 1 For the formation of the PLD, the CCEE must use the same models and input data adopted by ONS to prepare the PMO and reviews, disregarding the internal electrical restrictions to each submarket.

According to specialized doctrine, the calculation of the PLD:

(…) “is based on ex-ante order, that is, it is calculated based on forecasted information, prior to the system’s actual operation, considering the declared availability values of generation and forecasted consumption of each submarket. The complete PLD calculation process consists of using the NEWAVE and DECOMP computational models, which produce as a result the Marginal Cost of Operation for each submarket, respectively on a monthly and weekly basis.”

It should be noted that in the case study conducted in this article, the PLD was still on a weekly basis, with minimum and maximum limits set by ANEEL, pursuant to the sole paragraph of article 19 of Normative Resolution No. 843/2019:

Art. 19. The purpose of the PLD is to value the amounts that will be settled in the Short-Term Market – MCP, based mainly on the result of the PMO.

Sole paragraph. The PLD will be determined weekly for each load level based on the CMO, limited by a maximum and minimum value, as per ANEEL’s regulation.

However, as of January 2021, the PLD became hourly based, according to § 2 of art. 19 of Normative Resolution No. 843/2019, as amended by Normative Resolution No. 910/2020, and as determined by the MME Directive No. 301/2019, through the use of the DESSEM mathematical model in the system’s very short-term programming.

The adoption of the hourly PLD is the materialization of an important milestone for the free market of electricity in Brazil, so that the price signal is as close as possible to the operational reality. However, one cannot forget about the existence of an apparent dichotomy in this scenario, insofar as the PLD is formed by a database resulting from the PMO, which has nothing to do with market price formation. On the other hand, the PLD itself is based on minimum and maximum values established by ANEEL and does not take into account the most relevant situations of the system’s operation, such as dispatches outside the merit order and other restrictions.

In other words, the PLD cannot be considered a clear and adequate indicator of price formation for the market, to the extent that it is influenced by regulatory interventions that are far from the desired freedom, converging to the marginal cost price of electricity. Since the PLD is directly related to the CMO, in a hydrothermal system like the Brazilian one, with a large storage capacity, the variability of the short-term price is a problem linked to the cost of water and its affluence has a great impact on the mathematical models used in centralized order.

Although the regulator demonstrates a willingness to maintain a free market development environment in the electricity sector in Brazil, the economic signaling of the price does not have the same characteristic as in other countries. In other markets, such as parts of continental Europe and England, price signaling is provided through auctions of energy for next-day supply, with prices offered by generators and consumers.

It is important to note that, even though in these markets intermittent renewable sources already account for a considerable percentage of the electricity matrix, the fact is that the predominant source is thermal and the biggest variable is the price of the fuel. In general, intermittent sources are financed through charges as a result of incentives given by governments and borne by consumers. In other words, there is a predictability in the generation of electricity, which makes the offer of prices viable and benefits the more efficient generating agents with lower operating costs. In short, the economic indication of prices, in general, is very close to the reality of the operation.

The same scenario cannot be envisaged in Brazil, due to the peculiarities of the system heavily based on hydroelectricity, with storage capacity, and the legal and regulatory framework in force. In the Brazilian system, as already mentioned, the centralized order of hydroelectric and thermal generating units aims to operate at the lowest possible global cost, with large energy displacements between the sub-regions.

In addition, hydraulic plants usually operate in cascade, with several generating agents upstream and downstream of the same hydrographic basin, besides having their reservoirs shared for other economic activities, which, in a way, prevents the price offering by the agents themselves, being ONS the responsible for determining which generating units can be dispatched to operate according to a cost classification given by the mathematical models.

This centralization of the operation established by the current regulatory framework of the electricity sector in Brazil generates a clear asymmetry of information between the institutional agents, the regulator and the free market agents regarding the formation and reference of prices, to the extent that data are unilaterally inserted into the mathematical models, and, as a result, concepts such as transparency and predictability emerge and interact in the legal relationships existing in the free electricity market.

THE CONTROVERSY FORMED AND THE DECISION OF THE NATIONAL ELECTRIC ENERGY AGENCY – ANEEL

It is not too much to emphasize that the planning of the operation programming of the Brazilian electrical system faces several variables, due to the characteristic of its electrical matrix, strongly based on hydraulic generation.

In addition, the operation of the reservoirs of hydraulic generators must respect the multiple use of water, ranging from flood control to issues related to water supply and sanitation. Therefore, system planning and operation seeks predictability that transitions between the mathematical probability of models to the peculiarities of real-time operation.

In these terms, since the main function of a central system operator is to operate at the lowest possible global cost, any and all situations seen in very short term that can add lower costs to the system should be incorporated.

However, the operation of the system must comply with the current regulation. While it is expected and prudent that regulation should provide for specific technical situations, respecting the technical discretion that underlies the concept of regulation, the fact is that some determinations seem contradictory to the physical world of operation of an electric system.

Therefore, upon becoming aware of the update of data in the PEN and which resulted in changes in the products extracted from the PMO and the Daily Operation Schedule, the Brazilian Association of Energy Sellers questioned ANEEL about the procedure carried out by the ONS, through administrative appeal No. 48513.032049/2020-00, dated December 4, 2020, sustaining that there would be a disrespect of the anteriority of information to the market, as provided in § 1 of art. 3 of Resolution No. 7/2016 of the National Energy Policy Council – CNPE:

Art. 3 (…) § 1 Changes to the input data that do not result from error correction or periodic updating with a pre-established schedule, as regulated by ANEEL, must be communicated to the agents at least one month in advance of the Monthly Operation Program – PMO in which they will be implemented in order to have an effect on price formation and in the definition of operating policy.

According to the argument presented, by changing the input data of the mathematical models and generating changes in price formation with impacts on the PLD, there would be a need for such implications to be implemented only in the following month, with the referred change in the PLD, giving predictability to the free market and short-term operations.

The questioning was duly analyzed in Technical Note 137/2020-SRG/ANEEL, prepared by the Superintendence of Regulation of Generation Services, which recommended the rejection of the request, sustaining that the referred data update was provided for in the network procedures observed by ONS, for which reason there would be no need to observe the anteriority rule provided for in CNPE Resolution no. 7/2016.

The conclusion defended by SRG/ANEEL was based on the existence of a pre-established schedule for updating the data referring to the hydraulic restrictions, considering for this the provision contained in the network procedures in effect in 2020, specifically in Submodule 7.2, table 3, which states:

In other words, by updating the hydraulic restriction data in the PEN, which could be done at any time, and running the long and medium term operation simulations, the results obtained consequently subsidized the PMO simulations, which coincidentally was in its first week of revision.

Soon, the new results were applied and culminated in new CMO and PLD values, since the same mathematical models and data are used by CCEE to set the settlement price for differences. The conclusion of SRG/ANEEL was published on December 14, 2020 in the Official Gazette of the Union, through Order No. 3,513, dated December 11, 2020.

However, a commercializing agent of the sector filed an administrative appeal with a request for suspensive effect against Technical Note no. 137/2020-SRG/ANEEL, to request provisionally the suspension of the effects of SRG/ANEEL Order no. 3.513/2020 ANA Normative Resolution No. 51/2020 on the PLD in the month of December/2020, and the issue was taken to ANEEL’s Collegiate Board of Directors.

When analyzing the issue, in its 14th Extraordinary Public Meeting of the Collegiate Board of Directors, on December 21, 2020, ANEEL, by majority vote, decided to grant the precautionary measure, with prospective effects, which means that the effects of the suspension decision would apply only in the subsequent operating week, publishing the Order No. 3.622, of December 21, 2020.

The arguments that convinced the majority of ANEEL’s Collegiate Board of Directors were that the policy hierarchically superior to the network procedures protects price predictability to the detriment of the accuracy of the scenarios resulting from the mathematical models.

It is important to point out that the judgment on December 21, 2020 dealt only with the precautionary request proposed by the agent, with the administrative appeals filed up to the time of writing of this article still pending analysis by SRG/ANEEL.

The relevant point between the controversy that arose and the decision of the regulatory agency is the protection of the legitimate expectation of the free market agents in relation to the value of the price for settlement of differences given by the mathematical models. When ONS publishes the data on the marginal cost of operation and this same data is used by CCEE to publish the value of the PLD, the free market agents create an expectation of value on the available information and from this they engage in various legal businesses embodied in contracts with other agents in the sector. This chain of legal relations is built on objective bases, that is, on the data made available by the institutional agents, and gives rise to the formation of a legitimate expectation that this data will come true.

The change in the data already published by institutional agents and that may affect the value of the PLD would break the legitimate expectation that permeates legal

relations, constituting an affront to the principle of legal safety. Thus, it is not too much to say that the rule of anteriority, embodied in CNPE Resolution No. 7/2016 and ANEEL Normative Resolution No. 843/2019, is ultimately the materialization of the principle of legal safety.

It should not be forgotten that the PLD price formation, given by mathematical models approved and authorized by ANEEL and through institutions also regulated and inspected by the regulatory agency, has the characteristics of an administrative act, at least in the current legal and regulatory model of the Brazilian electrical sector, and, for this reason, it must respect the principles attached to the public administration, especially the principle of legal safety, which is confused with the protection of legitimate expectation and good faith, as well described by Maria Sylvia Zanella Di Pietro:

“The principle of trust protection protects the good faith of the administered; in other words, the trust that is protected is the one that the private individual places in the Public Administration.” (Direito Administrativo, 32nd ed., Rio de Janeiro: Forense, 2019, p. 116)

It is important to emphasize that the protection of legitimate expectations is not a safe harbor for the annulment of business risks and activities of free market agents. On the contrary, it is assumed that the acting agents know exactly the risks of their operations, being able to operate in the face of market variables characteristic of a complex and regulated sector.

However, it is not acceptable that the insertion of data in mathematical models used for planning and operation of the system be made without prior publicity and with the potential to alter PLD values that have already been published and informed to the market. As Celso Antônio Bandeira de Mello considers on the legal safety of public administration acts in relation to the administrators:

“By force of this very principle (together with those of the presumption of legitimacy of administrative acts and of loyalty and good faith), the correct understanding has been established that guidelines established by Administration in a given matter cannot, without prior and public notice, be modified in specific cases for the purpose of sanctioning, aggravating the situation of the administrators or denying them their claims, in such a way that it will only apply to cases ocurred after such notice” (Curso de Direito Administrativo, 15th edition, São Paulo: Ed. Malheiros, 2003, p. 114).

There are even precedents from the Federal Supreme Court, ratifying the understanding exposed here, as it can be seen in the excerpt from the report by Minister Roberto Barroso:

“Ultimately, the principle of legitimate trust is intended primarily to protect expectations legitimately created in individuals by state acts” (ARE 823985 AgR, Rapporteur: ROBERTO BARROSO, First Panel, judged on 03/23/2018, ELECTRONIC PROCESS DJe-070 DIVULG 04-11-2018 PUBLIC 04-12-2018).

The rule of anteriority, then, appears as a safeguard for the legitimate expectations of the free market agents, privileging the principle of legal safety of the acts of the public administration and of those who operate under its supervision and regulation.

CONCLUSION

First of all, it should be noted that the conclusion of ANEEL’s Collegiate Board of Directors is correct from the regulatory point of view and from the principle of legal

safety, ultimately embedded in the rule of anteriority, even if there is a mismatch with the daily operation of the SIN.

This is because both CNPE Resolution no. 7/2016 and ANEEL Normative Resolution no. 843/201927 provide for the need to respect the rule of anteriority, i.e., it determines that changes in the data in the mathematical models that reflect in the PLD must be published thirty days in advance, so that the free electricity market has predictability, so that the legitimate expectation of such agents is respected. In the words of Wallace Paiva Martins Junior:

“Administrative publicity is instrumental to legal safety. The provision of visibility of administrative action provides public knowledge and, therefore, calculability and predictability of activities, conduct, understandings and guidance by the administrators so that they can develop their purposes” (Tratado de direito administrativo: teoria geral e princípios do direito administrativo, 2nd ed., São Paulo: Thomson Reuters Brasil, 2019, p. 633).

Obviously, one cannot ignore the fact that the operation of the SIN should mitigate the variable factors, so that the marginal cost of operation and the PLD reflect values closer to the operating reality. In fact, this is the scope of the existence of a central system operator, who seeks operational optimization at the lowest possible global cost.

However, the existence of several players in the electricity sector requires the respect for a predictability of acts that impact the daily relationships between agents, making up what is called regulatory stability, which ultimately characterizes the principle of legal safety, which, as Sergio Guerra explains:

“(…) represents, in this way, the idea of a set of conditions that can make it possible for society to have prior knowledge of the consequences of its actions in light of norms pre-established by the legal system.”

It is clear that the PLD value does not correspond exactly to the CMO, since, for example: (1) it has minimum and maximum limitation established by the regulatory agency and (2) it does not reflect several situations that impact the operating cost, such as the dispatch out of the merit order of thermal plants for energy security, whose cost is borne through a charge.

However, it should not be forgotten that the PLD is a reference for the commercialization of electricity in the free contracting environment and in the interaction of the agents that make up the sector, which is the reason why the regulation in force takes an indicative position that predictability is an institute to be protected in detriment of the mathematical precision of the models used.

The situation narrated in the previous lines demonstrates that a highly regulated sector demands a holistic analysis, and it is up to each of its institutional players not to stick only to mathematical and operational criteria. A demonstration of this need are the studies and planning carried out with long, medium, and short term horizons, which encompass probabilistic and deterministic factors, besides an infinite number of interactions with other institutional agents.

The correctness of the decision handed down by the regulatory agency, however, cannot be considered as an appeasement of the situation. This is because, to the extent that a supposed predictability of PLD values is preserved, its increasing detachment from the operating reality seems to go against the expectation of obtaining prices increasingly adherent to the real cost of operation, which is desired by the market.

With the hourly PLD coming into effect and the development of another mathematical model – DESSEM – for very short-term centralized order, there is a sign of a search for precision in the operation and settlement of the short-term market.

Faced with a system that already coexists with several climatic, social and regulatory variables, a precedent that respects and favors the rule of anteriority for changes that impact the PLD is important, but more coherent would be to update all procedures observed by the system operators and the market, in order to exercise their institutional functions in a clear and aligned manner with the regulation in force and respecting the objective bases of the legal business signed in the electricity trading environment.